The Texas Life and Health Insurance Exam assesses knowledge of insurance principles, policies, and regulations. It covers life insurance concepts, health insurance plans, legal requirements, and Texas-specific rules. Passing ensures competency in providing insurance services.

1.1. Overview of the Exam

The Texas Life and Health Insurance Exam is a comprehensive assessment designed to evaluate an individual’s understanding of life and health insurance concepts, policies, and regulations. The exam is divided into two main sections: life insurance and health insurance. The life insurance portion covers types of policies, such as whole life, term life, and universal life, as well as riders and add-ons. The health insurance section focuses on plan types, including HMOs, PPOs, and Medicare/Medicaid programs. Additionally, the exam includes questions on legal and ethical considerations, underwriting processes, and Texas-specific insurance regulations. Candidates are tested on their ability to apply knowledge in real-world scenarios, ensuring they are prepared to provide accurate and compliant insurance services. The exam format typically includes multiple-choice questions, and candidates must achieve a passing score to obtain their license. Proper preparation, including detailed study guides and practice exams, is essential for success.

1.2. Importance of Passing the Exam

Passing the Texas Life and Health Insurance Exam is crucial for individuals seeking to become licensed insurance professionals in the state. It ensures they possess the necessary knowledge and skills to provide accurate and compliant services to clients. A license is required to legally sell life and health insurance products in Texas, making the exam a critical step in career advancement. By passing, individuals demonstrate their understanding of state-specific regulations, ethical practices, and industry standards. This credential enhances credibility and trust with clients, fostering long-term professional relationships. Additionally, it opens opportunities for career growth and higher earning potential in the insurance field. The exam also ensures agents can navigate complex legal and regulatory landscapes, protecting both themselves and their clients from potential risks. Ultimately, passing the exam is a hallmark of professional competence and commitment to excellence in the insurance industry.

Key Concepts in Life Insurance

Life insurance provides financial protection to policyholders’ families upon death. Key concepts include term, whole, and universal life policies, riders, and beneficiaries. Understanding these principles is essential for meeting clients’ needs and ensuring coverage.

2.1. Types of Life Insurance Policies

Life insurance policies are categorized into several types, each designed to meet specific financial needs. Term life insurance provides coverage for a defined period, such as 10, 20, or 30 years, and pays a death benefit if the insured dies within the term. Whole life insurance, also known as permanent life insurance, offers lifelong coverage with a guaranteed death benefit and a cash value component that grows over time. Universal life insurance combines flexibility in premiums and death benefits with a savings element, allowing policyholders to adjust their coverage as needed. Variable life insurance ties the cash value to investments, offering potential growth but with market risks. Understanding these types is crucial for tailoring insurance solutions to individual circumstances and ensuring adequate protection for beneficiaries.

2.2. Riders and Add-ons for Life Insurance

Life insurance policies can be customized with riders and add-ons to enhance coverage and flexibility. A waiver of premium rider ensures premiums are waived if the policyholder becomes disabled or critically ill. The accelerated death benefit rider allows access to a portion of the death benefit if the insured is terminally ill. A long-term care rider provides funds for long-term care expenses while the policyholder is alive. Other common riders include guaranteed insurability, which enables future increases in coverage without medical exams, and child protection riders, offering coverage for dependent children. These add-ons tailor policies to individual needs, providing additional security and financial support in various scenarios. Understanding these options is essential for creating a comprehensive life insurance plan that addresses specific life circumstances and goals.

Key Concepts in Health Insurance

Health insurance provides coverage for medical expenses, ensuring access to healthcare services. Key concepts include types of plans (HMOs, PPOs, EPOs), provider networks, and cost-sharing elements like deductibles, copays, and coinsurance.

3.1. Types of Health Insurance Plans

Health insurance plans vary to meet diverse needs, with common types including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). HMOs require members to use in-network providers except in emergencies, often with lower premiums. PPOs offer more flexibility, allowing out-of-network care at higher costs. EPOs combine elements of HMOs and PPOs but typically exclude out-of-network coverage unless it’s an emergency. Additionally, Medicare and Medicaid provide coverage for specific populations, with Medicare serving seniors and Medicaid assisting low-income individuals. Understanding these plans is crucial for Texas insurance professionals, as they must align coverage with client needs and comply with state regulations. The Texas Department of Insurance oversees these plans, ensuring they meet legal standards. Agents must be well-versed in plan details to guide clients effectively. This knowledge is essential for passing the Texas Life and Health Insurance Exam and providing competent service.

3.2. Medicare and Medicaid Overview

Medicare and Medicaid are two key government-sponsored health insurance programs in the U.S., each serving distinct populations. Medicare is a federal program primarily for individuals 65 or older, certain younger people with disabilities, and those with End-Stage Renal Disease. It consists of Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage). Enrollment is typically automatic for eligible individuals. On the other hand, Medicaid is a joint federal-state program providing health coverage to low-income individuals, including families, children, and people with disabilities. Eligibility and benefits vary by state, with Texas implementing specific guidelines. Both programs play a vital role in ensuring healthcare access for vulnerable populations. Understanding their differences, coverage, and eligibility criteria is essential for insurance professionals in Texas, as they often interact with clients who rely on these programs. This knowledge is also critical for passing the Texas Life and Health Insurance Exam, as it addresses government-sponsored health plans in detail.

Legal and Ethical Considerations

Legal and ethical considerations are crucial in Texas life and health insurance. Professionals must comply with state laws, avoid conflicts of interest, maintain confidentiality, and act in clients’ best interests to ensure fair practices.

4.1. Insurance Laws in Texas

Texas insurance laws are designed to protect consumers and ensure fair practices. The Texas Department of Insurance (TDI) oversees regulations, including policy disclosures, claims handling, and agent licensing. Key laws cover fraud prevention, policy cancellations, and non-discrimination. Agents must understand these statutes to operate legally and ethically, ensuring compliance with state and federal mandates. Violations can result in penalties, fines, or license revocation. Staying updated on legal changes is essential for professionals in the industry. These laws aim to maintain transparency and accountability, fostering trust between insurers and policyholders. They also outline specific requirements for life and health insurance products, ensuring they meet minimum standards. Familiarity with these laws is critical for exam success and professional integrity in Texas. Proper adherence ensures a balanced and fair insurance market.

4.2. Ethical Practices in Insurance

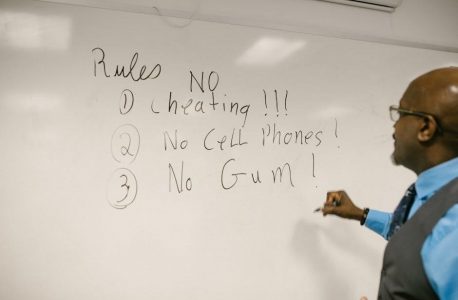

Ethical practices in insurance are foundational to building trust and integrity. Agents must act in the best interest of clients, avoiding conflicts of interest. Transparency and honesty are crucial when presenting policies. Ethical standards include maintaining confidentiality, providing accurate information, and avoiding misleading sales tactics. Agents should not coerce clients into purchases and must disclose all policy terms. Professional conduct ensures fair treatment of all customers. Violations of ethical standards can lead to legal consequences and damage to reputation. Staying informed about industry ethics is vital for maintaining a trustworthy relationship with clients. Ethical practices also involve ongoing education and adherence to regulatory guidelines. By upholding these principles, insurance professionals contribute to a fair and reliable market. Ethical behavior fosters long-term client relationships and supports the overall integrity of the insurance industry. Adherence to these standards is a key component of professional success and accountability.

Underwriting and Risk Assessment

Underwriting evaluates risk factors to determine policy eligibility and premiums. Insurers assess health, lifestyle, and financial stability. Risk classification tools help set coverage terms. Accurate assessment ensures fair pricing and policy issuance.

5.1. The Underwriting Process

The underwriting process is a critical step in determining policy eligibility and premium rates. It involves evaluating an applicant’s health, lifestyle, and financial stability to assess risk levels. Insurers review medical history, lab results, and other data to make informed decisions. For life insurance, factors like age, occupation, and hobbies are considered. Health insurance underwriting may examine pre-existing conditions and health status. The process aims to balance risk and coverage, ensuring fair pricing. Automated systems and actuarial tables often aid underwriters in making consistent decisions. Understanding this process is essential for agents to explain policy terms to clients. Proper underwriting ensures sustainable coverage and protects both the insurer and the insured. It is a foundational concept for success in the Texas Life and Health Insurance Exam.

5.2. Risk Classification and Factors

Risk classification is the process of grouping applicants based on their likelihood of filing a claim. Insurers use various factors to determine policy eligibility and premium rates. Health status, medical history, and lifestyle habits are key considerations. For life insurance, factors like age, occupation, and hobbies are evaluated. In health insurance, pre-existing conditions and health indicators like BMI are assessed; Other factors include tobacco use, family medical history, and high-risk activities. Actuarial tables and statistical data guide underwriters in categorizing risks. Higher-risk applicants may face higher premiums or coverage limitations. Understanding these factors is crucial for agents to advise clients appropriately. The goal of risk classification is to ensure fair and accurate pricing while maintaining coverage availability. This process is essential for sustaining the insurer’s financial stability and providing appropriate protection for policyholders. Mastery of this concept is vital for success on the Texas Life and Health Insurance Exam.

Texas-Specific Insurance Regulations

Texas insurance regulations are governed by the Texas Department of Insurance (TDI), ensuring compliance with state laws. These rules protect consumers and providers, covering policies, rates, and claims processes. Understanding them is essential for licensure and practice.

6.1. Role of the Texas Department of Insurance

The Texas Department of Insurance (TDI) plays a crucial role in regulating the insurance industry within the state. Its primary responsibilities include overseeing insurance companies, enforcing state insurance laws, and protecting consumer rights. TDI ensures that insurance providers operate fairly and transparently, maintaining financial stability to meet policyholder obligations. Additionally, the department handles complaints against insurers, resolves disputes, and provides educational resources to help consumers make informed decisions. TDI also sets standards for insurance products, including life and health policies, to ensure they meet state requirements. By maintaining a balanced regulatory environment, TDI supports both the industry and the public, fostering trust and stability in the insurance market. Understanding TDI’s functions is essential for anyone preparing for the Texas Life and Health Insurance Exam, as it directly impacts the legal and operational aspects of insurance practices in the state.

6.2. Licensing Requirements for Insurance Professionals

In Texas, insurance professionals must meet specific licensing requirements to legally sell life and health insurance products. The Texas Department of Insurance (TDI) oversees the licensing process, ensuring that agents and brokers meet educational, ethical, and legal standards. To obtain a license, applicants must complete a state-approved pre-licensing education course, which covers life and health insurance concepts, ethics, and Texas-specific regulations. After completing the coursework, candidates must pass the Texas Life and Health Insurance Exam, demonstrating their knowledge of insurance policies, laws, and practices. Additionally, applicants must undergo a background check and submit their application through the National Insurance Producer Registry (NIPR). Once licensed, professionals must comply with continuing education requirements to maintain their credentials. These requirements ensure that insurance professionals are qualified to provide accurate guidance and protect consumer interests. Understanding these licensing steps is vital for anyone seeking to become an insurance professional in Texas.

Study Strategies for Success

Effective study strategies include active learning techniques, such as using flashcards and practice tests. Prioritize complex topics and schedule regular review sessions to ensure comprehensive understanding and retention of material.

7.1. Effective Study Techniques for Exam Preparation

Effective study techniques are crucial for success in the Texas Life and Health Insurance Exam. Begin by organizing your study materials, such as the free study guide PDF, into structured notes and summaries. Active learning methods like creating flashcards for key terms and concepts can enhance retention. Utilize practice exams to familiarize yourself with the test format and identify weak areas. Allocate specific time slots for each topic, ensuring balanced coverage of life and health insurance sections. Engage in regular review sessions to reinforce understanding and reduce cramming. Additionally, incorporate mnemonic devices or mind maps to visualize complex information. Taking short breaks between study sessions can improve focus and prevent burnout. Lastly, simulate exam conditions during practice to build confidence and time management skills. By consistently applying these strategies, you can approach the exam with confidence and achieve your goals.

7.2. Time Management Tips for Comprehensive Study

Effective time management is essential for comprehensive study preparation. Create a detailed study schedule, allocating specific time blocks for each topic, such as life insurance policies, health insurance plans, and Texas-specific regulations. Prioritize challenging subjects and dedicate extra time to mastering them. Break your study sessions into shorter, focused intervals with regular breaks to maintain concentration. Utilize free study guides and practice exams to identify weak areas and allocate time accordingly. Consistency is key—study regularly rather than cramming. Set realistic goals for each session and track your progress; Consider using digital tools or planners to organize your study materials and deadlines. Finally, review and adjust your schedule as needed to ensure all topics are thoroughly covered. By managing your time effectively, you can ensure a balanced and efficient study process.

Practice Exams and Resources

Free practice exams and study guides are available online, including PDF resources. Utilize platforms like Quizlet for flashcards and practice tests to reinforce your understanding of life and health insurance concepts.

8.1. Finding Free Practice Exams Online

Finding free practice exams online is a great way to prepare for the Texas Life and Health Insurance Exam. Websites like Quizlet offer a variety of flashcards and study guides that cover key topics such as life insurance policies, health insurance plans, and Texas-specific regulations. Additionally, platforms like Google provide advanced search options to find PDF resources, including practice tests and study materials. You can use specific search phrases or filters to narrow down your results and access relevant study aids. Many educational forums and websites also share free practice exams, allowing you to simulate the actual test experience. Utilizing these resources effectively can help you assess your knowledge gaps and improve your overall exam readiness. Regularly practicing with these materials will enhance your confidence and performance on the exam day.

8.2. Additional Study Materials and Guides

Beyond practice exams, there are numerous additional study materials and guides available to help prepare for the Texas Life and Health Insurance Exam. Textbooks and online courses provide in-depth explanations of key concepts, such as life insurance policies, health insurance plans, and Texas-specific regulations. Many resources are available in PDF format, making them easily accessible for download and offline study. Websites like Quizlet offer flashcards and interactive study tools to reinforce memorization of important terms and concepts. Additionally, study guides tailored to the Texas exam often include summaries of state laws, underwriting processes, and ethical practices. These materials are designed to complement practice exams by offering a deeper understanding of the subject matter. Utilizing these resources alongside practice tests can significantly improve your readiness for the exam. By combining structured study guides with interactive tools, you can create a comprehensive study plan tailored to your needs.

Final Exam Tips and Tricks

Beyond practice exams, numerous study materials are available to aid in preparing for the Texas Life and Health Insurance Exam. Textbooks and online courses offer detailed explanations of life insurance policies, health insurance plans, and Texas-specific regulations. Many resources are available in PDF format, making them easily accessible for download and offline study. Websites like Quizlet provide flashcards and interactive tools to help memorize key terms and concepts. Study guides tailored to the Texas exam often include summaries of state laws, underwriting processes, and ethical practices. These materials complement practice exams by offering a deeper understanding of the subject matter. Additionally, some guides include tips for test-taking strategies and time management. Utilizing these resources alongside practice tests can significantly improve readiness for the exam. By combining structured study guides with interactive tools, you can create a comprehensive study plan tailored to your needs, ensuring a thorough preparation for the Texas Life and Health Insurance Exam.

9.1. Test Day Preparation and Strategies

On test day, arrive early and bring necessary documents like a valid ID and approval letter. Skim through the exam format beforehand to familiarize yourself with question types. Allocate time wisely, spending no more than two minutes per question initially. Return to challenging questions after completing easier ones. Read each question carefully, paying attention to key terms like “except” or “not.” Eliminate incorrect answers first to increase chances of selecting the right one. If stuck, make an educated guess rather than leaving it blank. Stay calm and avoid overthinking. Use breaks if allowed to refresh your mind. Lastly, review answers before submitting to ensure accuracy. Utilize free study guides for last-minute reviews, focusing on high-probability topics. These strategies will help maximize your performance and confidence during the exam.

9.2. Final Words of Encouragement and Success

Reaching this point in your preparation is a testament to your dedication and hard work. Remember, success is within your grasp. Trust the knowledge you’ve gained and the strategies you’ve mastered. Approach the exam with confidence and a positive mindset. It’s normal to feel nervous, but channel that energy into focus. Visualize your success and remind yourself of the reasons you embarked on this journey. You’ve studied thoroughly, utilizing free study guides and practice exams to strengthen your understanding. Stay composed, read each question carefully, and apply what you’ve learned. Celebrate your perseverance and know that this milestone is just the beginning of a rewarding career in insurance. You’ve got this—go out there and make it happen!